Imagine a world free from the typical fears and concerns of solar financing for homeowners. Investing in solar energy is a major decision—often only slightly behind buying a home or a car. Solar financing can feel daunting, as many worry about high upfront costs, complex loan terms, and waiting for tax credits. Cengage Financial is transforming this landscape by eliminating these typical hurdles and providing safer, more flexible financing options than traditional methods. With SunGage, there’s no requirement to use your home as collateral, nor do you need to deal with fluctuating interest rates, making this a secure alternative for homeowners.

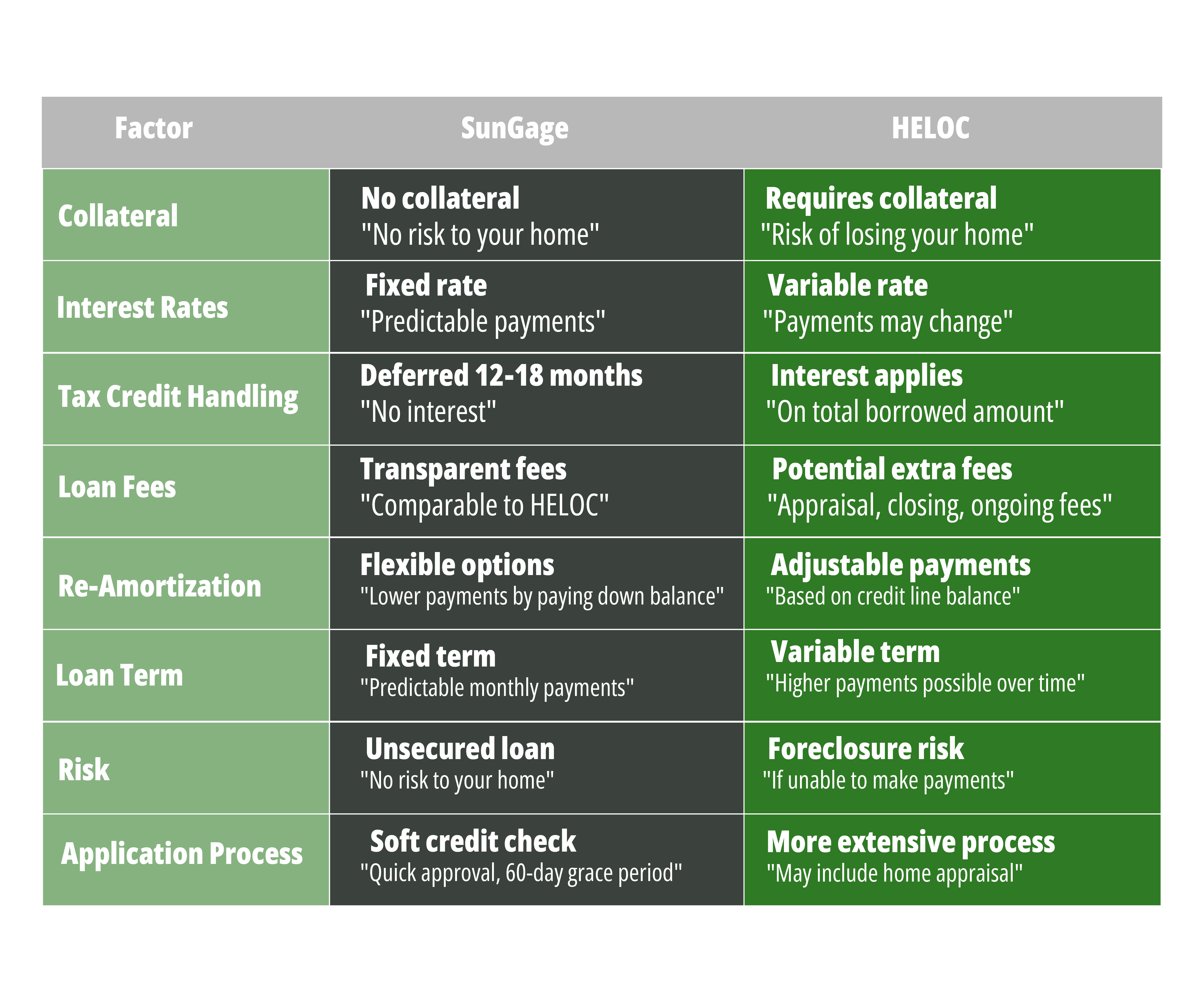

Many homeowners consider using HELOCs (Home Equity Lines of Credit) to fund solar projects. However, this option requires using their home as collateral, which can put their property at risk if payments are missed. HELOCs also come with variable interest rates, adding complexity to the repayment process. In contrast, SunGage Financial’s solar loans do not require home collateral, providing additional security should financial situations change.

SunCage Financial provides a better way to finance solar installations with transparent and flexible terms. Homeowners can benefit from tax credits without incurring interest during the waiting period. Additionally, re-amortization options allow adjustments to monthly payments or early loan repayment. SunGage makes solar financing accessible, affordable, and low-risk. This guide covers everything you need to know about financing solar with SunGage in 2024, helping you install solar without the stress and financial risks linked to other loan options.

As we’ll explore in this article, SunGage Financial helps homeowners access solar financing with minimal hassle, reduced risks, and more manageable terms than traditional HELOCs. SunGage makes solar funding accessible and secure, offering a straightforward path to installation without the stress and financial risks linked to other loan options. In the following sections, we’ll dive deeper into how SunGage’s unique features simplify solar financing for homeowners and why it stands out as a top choice for those investing in clean energy.

SunGage Financial’s Legacy in Solar Financing for Homeowners.

Since 2009, SunGage Financial has pioneered the residential solar financing market, transforming how homeowners fund their solar investments. As one of the first companies to offer specialized solar loans, it has remained a leader in the industry by continually adapting to meet evolving homeowner needs. Customizing its loans to maximize the benefits of solar energy, SunGage enables homeowners to transition to clean energy without added financial stress.

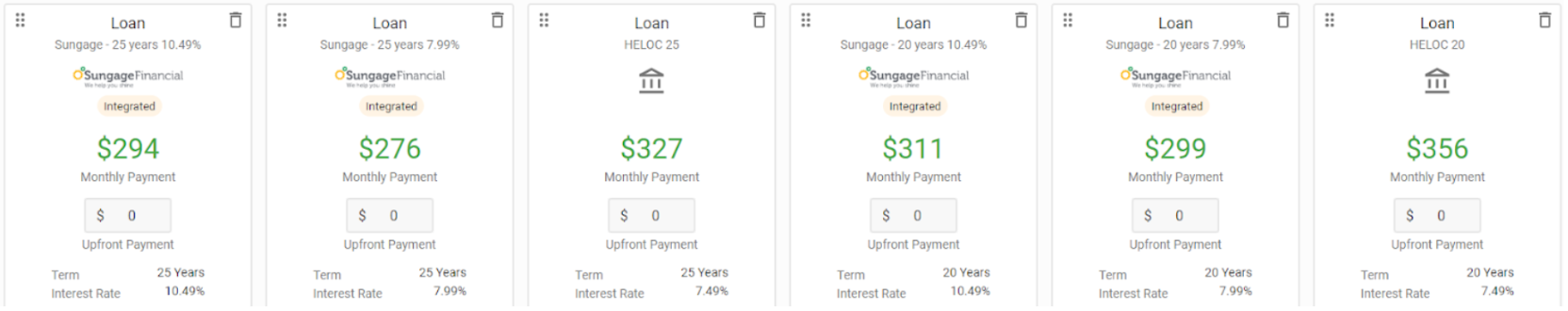

Below is a comparison of how SunGage Financial’s solar loan options stack up against traditional HELOCs:

No-Collateral Solar Financing for Homeowners

One of the biggest concerns homeowners face when financing a large project like solar installation is the risk of using their home as collateral. Traditional financing options, such as home equity lines of credit (HELOCs) and other secured loans, often require this, meaning missed payments could put the property at risk. For many, this requirement creates a significant roadblock to investing in solar energy, as they hesitate to use their most valuable asset as security.

SunGage’s Solution: Unsecured Solar Loans

SunGage Financial offers a solution through no-collateral solar financing. With SunGage’s unsecured solar loans, homeowners don’t need to link their property to the loan, eliminating foreclosure risk in cases of financial hardship. Instead, the loan is secured by the solar system itself. According to industry data, repossession rates for solar installations are extremely low in the U.S. This low rate is partly due to the financial improvements solar installations can bring to homeowners, with monthly loan payments often lower than typical utility costs. SunGage’s approach to solar financing is a game-changer, allowing homeowners to switch to solar without risking their homes.

Streamlined and Secure Financing

By removing the need for home collateral, SunGage safeguards your biggest asset and simplifies the financing process. No complex appraisals or home equity calculations are required—just a straightforward approval designed to get your solar project moving forward with minimal hassle and maximum peace of mind.

This flexibility and protection make SunGage an ideal choice for homeowners wanting to invest in solar energy without risking their homes. With SunGage Financial, you can focus on the long-term benefits of your solar investment, like energy savings and environmental impact, without the financial stress that often comes with secured loans.

While SunGage offers no-collateral solar loans, it’s essential to understand all available financing methods. Explore more about What Financing Options Are Available for Solar Installations? to make an informed decision.”

Introducing the “30s Split” Payment Option: Flexible Solar Financing with SunGage

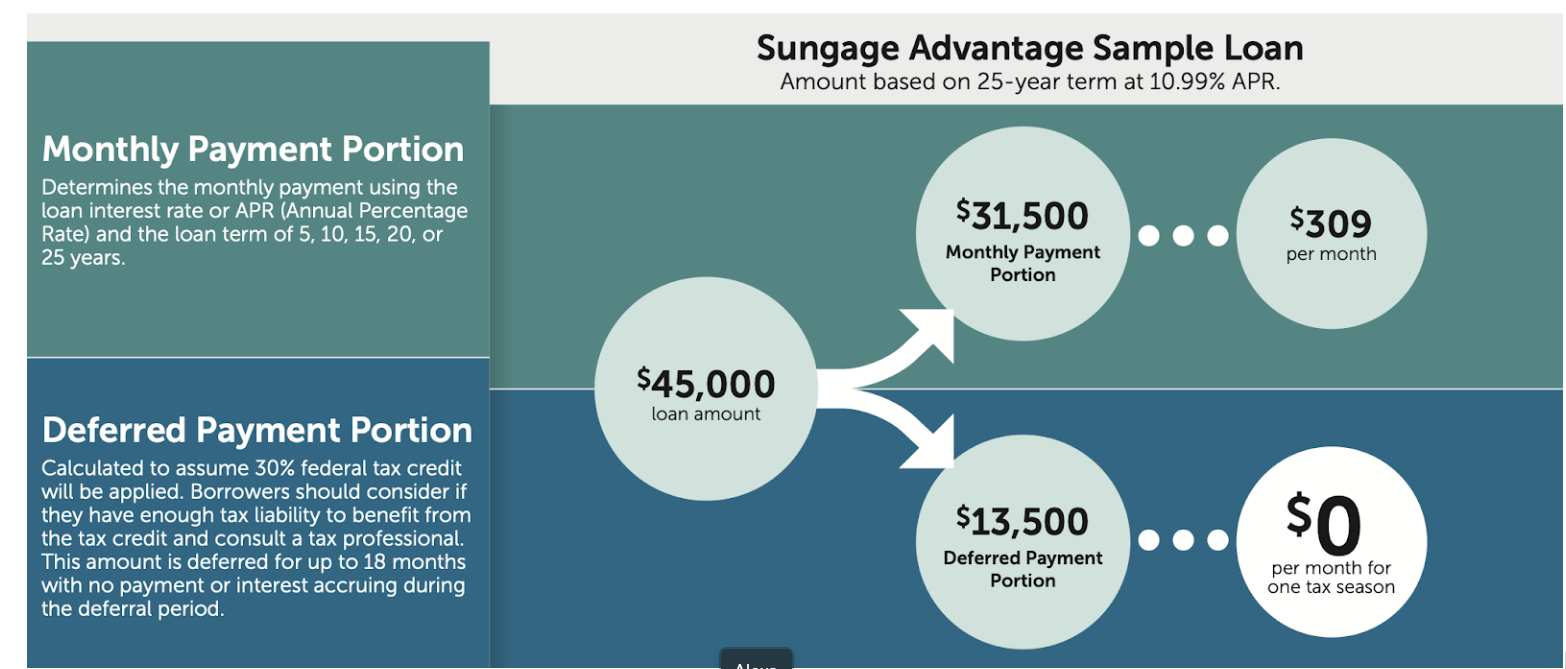

SunGage Financial’s latest innovation in solar financing, the “30s Split” payment option, offers homeowners increased flexibility with down payments and tax credits. Traditionally, solar loans require a large upfront payment, which can be challenging for many. The “30s Split” option changes this by allowing homeowners to defer the 30% federal tax credit for 12 to 18 months with 0% interest. This deferral lets homeowners enjoy low monthly payments without added interest, making SunGage’s solar loans highly competitive.

The “30s Split” payment option provides significant advantages for homeowners, including:

- Lower Monthly Payments: By deferring the tax credit, borrowers keep monthly payments lower during the initial months, making solar more accessible.

- 0% Interest on Deferred Amount: Homeowners aren’t charged interest on the deferred tax credit portion, minimizing extra costs.

- Financial Flexibility: This option provides a financial cushion, allowing homeowners to allocate funds where needed while benefiting from solar energy savings.

The Standard 10.99 UTC infographic below illustrates how the 30% tax credit is deferred and incorporated into SunGage’s loan structure, allowing homeowners to enjoy lower initial payments.

The infographic from SunGage explains the deferred payment portion and illustrates the unique structure of SunGage’s loan, which sets it apart from traditional financing options.

Why Choose SunGage’s 0% Interest on Tax Credit Deferral?

The 0% interest tax credit deferral option from SunGage offers several unique benefits, making it an attractive choice for homeowners seeking flexibility and savings in financing their solar projects. Here are the main reasons to consider this option:

1. Avoid Paying Interest on the Tax Credit Portion

One primary reason is that this option allows homeowners to defer the 30% federal tax credit without paying any interest on that amount. Usually, with traditional loans or HELOCs, homeowners would start accruing interest on the entire loan amount from day one, even though they have to wait up to a year to receive the tax credit from the government. With SunGage’s 0% interest deferral, homeowners don’t have to worry about additional interest accumulating while they wait for their tax refund.

2. Lower Initial Monthly Payments

The deferral can result in lower monthly payments during the loan’s first 12-18 months. Since the tax credit portion isn’t factored into the loan’s interest during this period, homeowners may enjoy more manageable monthly payments initially, giving them time to adjust financially while benefiting from solar energy savings.

3. Improved Cash Flow

The 0% interest deferral can help homeowners improve their cash flow. By deferring a large portion of the loan and not paying interest, they can use their cash for other essential expenses while waiting for the tax credit. This option can provide financial breathing room, especially during the first year after installation, when homeowners adapt to their new solar energy system.

4. No Penalty for Early Repayment

Homeowners anticipating paying off their loan early or applying the tax credit directly toward the principal once received would significantly benefit from this option. By deferring the tax credit without interest, they can plan to pay down the loan as soon as they receive their refund without having incurred unnecessary interest charges.

5. Peace of Mind

The 0% interest deferral provides peace of mind, especially for risk-averse people who don’t want to accrue debt for the tax credit portion while waiting for the refund. Knowing they won’t be charged interest on that portion of the loan allows homeowners to feel more financially secure during the loan’s initial stages.

Example: If the solar system costs $30,000, the federal tax credit of 30% ($9,000) would accrue interest over the waiting period with other loans. SunGage’s option allows you to defer that $9,000 at 0% interest, meaning you only pay interest on the remaining $21,000 during that time. This can save homeowners hundreds of dollars in interest.

Example: Instead of paying interest on a $30,000 loan, the homeowner would initially only be charged interest on $21,000, reducing the size of the payments and allowing time for the tax refund to come through.

Example: A homeowner can redirect funds they would have otherwise spent on higher loan payments or interest toward other necessary expenses, like home improvements or emergency savings, knowing they won’t face additional costs for deferring the tax credit.

Example: Once the homeowner receives their $9,000 tax credit, they can apply it directly to the loan principal, effectively reducing the loan balance with no added interest costs for that period.

Example:In contrast, traditional loans and HELOCs typically charge interest on the entire loan amount, including the tax credit portion, right from the start, increasing the total cost of borrowing. Choosing SunGage’s 0% Interest on Tax Credit Deferral can save homeowners money, reduce their financial stress, and make the loan more manageable during the crucial early phase of their solar investment.

Competitive Rates and Flexible Terms

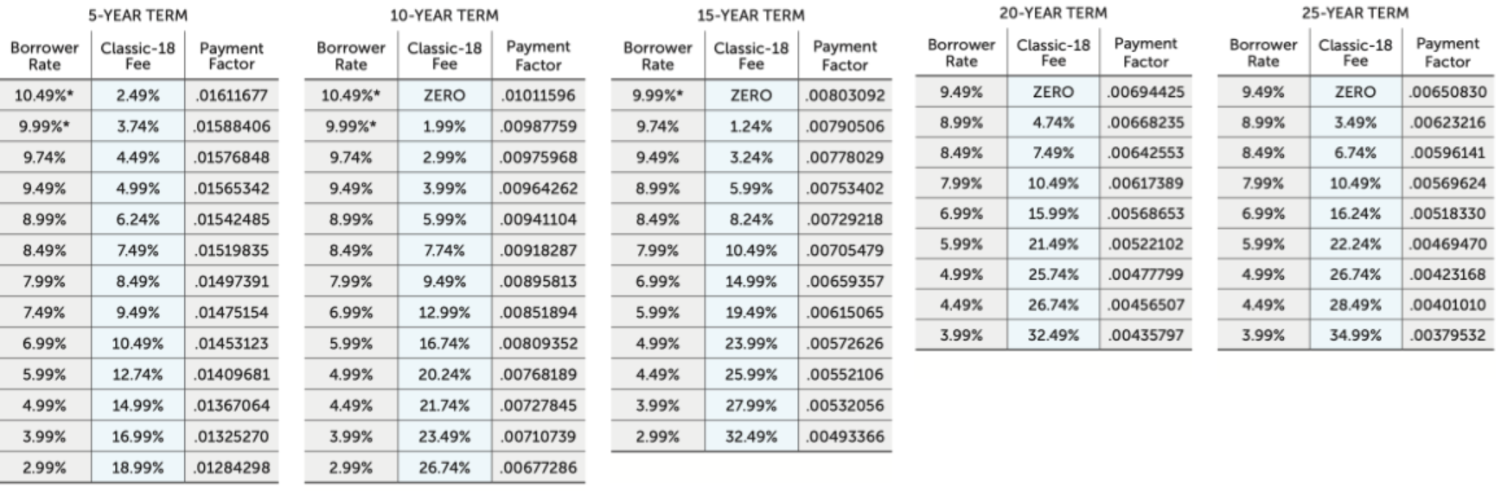

Kayl Enders, an industry expert, has compared SunGage’s competitive 9.49% interest rate with other lenders, emphasizing SunGage’s zero-fee structure as a significant advantage. The Classic-18 Rate Sheet provides an in-depth look at SunGage’s solar loan products, detailing the terms, fees, and payment factors that determine homeowners’ costs. This sheet clearly illustrates how SunGage’s rates compare favorably with other lenders, especially when combined with flexible terms and no hidden fees.

The rate sheet showcases SunGage’s transparent approach to loan terms, offering competitive rates with detailed payment factors to help you understand potential costs clearly. These Rates and fees were calculated as of 08/16/2024 and are subject to change. All quoted interest rates assume a 25% discount for borrower enrollment in ACH auto-pay for monthly loan payments. These payment factors are accurate in states with no state solar incentives. *Not available in New Hampshire and Texas.

Understanding the Payment Factor in the Classic-18 Rate Sheet

When reviewing SunGage Financial’s Classic-18 Rate Sheet, one critical term that stands out is the payment factor. But what is a payment factor, and how does it help you understand the cost of financing your solar installation?

The payment factor is a multiplier that allows you to calculate your monthly payment based on the total loan amount. This simplifies estimating monthly loan payments without needing complex interest calculations. By multiplying the total loan amount by the payment factor, you can quickly determine your monthly payment over the loan’s term.

For example, if you are borrowing $30,000 and the payment factor for your chosen term and interest rate is 0.00803092, you simply multiply:

$30,000 × 0.00803092 = $240.93 (your monthly payment).

Each term (5, 10, 15, or 25 years) has a corresponding payment factor reflecting the interest rate and loan duration. This feature makes it easier for homeowners to compare loan terms and understand how interest rates impact monthly payments.

Let’s take the next step in comparing SunGage to HELOC using OpenSolar.com, an online platform designed to make getting solar estimates more efficient while providing greater ease and transparency in financing a solar or battery installation.

The page above from OpenSolar.com provides an apples-to-apples comparison of financing options for a particular solar installation when specific parameters are provided. This allows homeowners to see how options stack up regarding monthly payments, interest rates, and loan terms.

As demonstrated, the monthly payments for a 20- or 25-year loan favor the SunGage options. Remember that exact figures may vary depending on the installation location and specific project details, but this comparison offers a helpful real-world example.

For those interested in a detailed breakdown, a line-by-line amortization sheet is available, showing the complete monthly payment schedule over a 25-year period. Feel free to download and review the pdf to see how SunGage’s financing structure can work for you.

How OpenSolar Integration Benefits Homeowners?

Financing solar projects through SunGage includes a key advantage: integration with OpenSolar, a platform that streamlines financing for homeowners by working with installers. Although homeowners don’t interact with OpenSolar directly, they benefit from its tools. OpenSolar enables vetted installers to present multiple lending options, helping homeowners easily compare and select the best financing plan without managing complex details themselves.

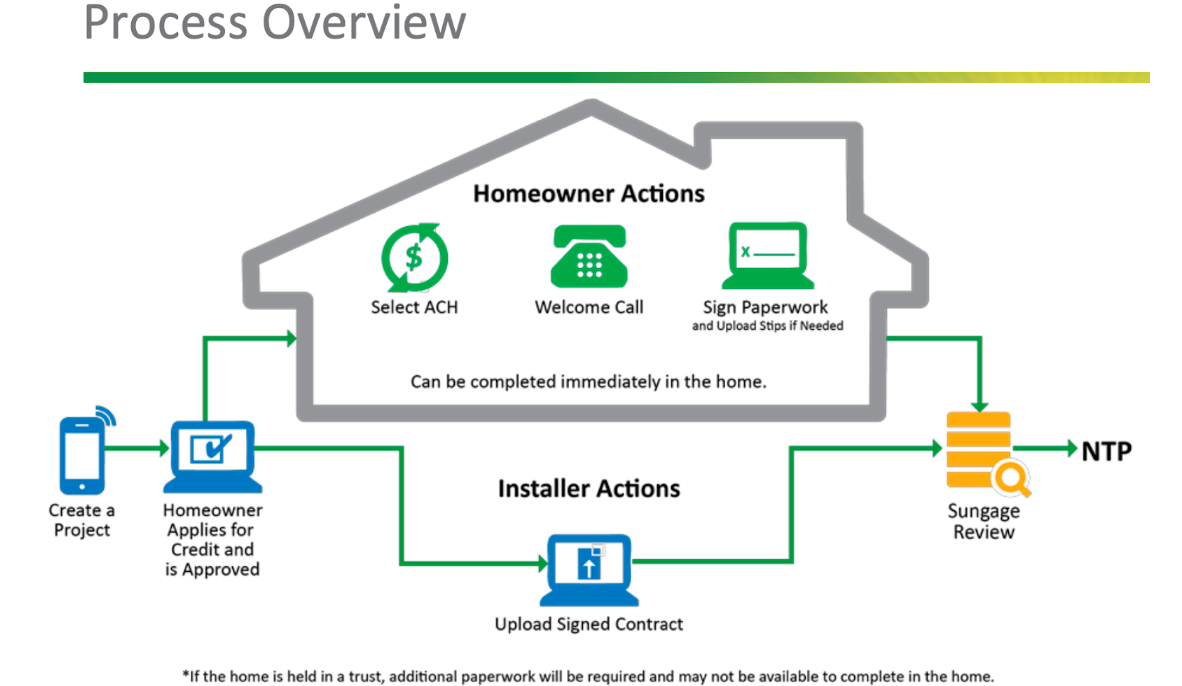

The SunGage Onboarding Process

The onboarding with SunGage starts with a soft credit check. After submitting signed contracts, a Notice to Proceed (NTP) is issued, marking the start of the project. Homeowners then enjoy a 60-day grace period before their first loan payment, giving them time to organize finances without immediate payment pressure.

The Role of Installers and OpenSolar

While homeowners finance the solar project, installers use the OpenSolar platform to manage the entire process. Every installer working with SunGage goes through a vetting process with SunGage to ensure they are reputable, provide quality work, and operate at a high volume. Thanks to these relationships with trusted, high-performing installers allow them to offer competitive rates.

This integration simplifies financing by eliminating the confusion and stress often associated with sorting through loan options. Thanks to the partnership with SunGage, installers can offer side-by-side comparisons of SunGage’s loan products, often at lower rates. This speeds up the decision-making process, ensuring homeowners work with vetted professionals and get the best possible terms.

By leveraging OpenSolar through its trusted installer network, SunGage delivers a seamless and efficient financing experience for homeowners. This integration ensures a smooth, stress-free financing journey with expert guidance at every step, eliminating the need for homeowners to manage technical or financial details themselves.

This process overview highlights SunGage’s easy and customer-friendly onboarding experience and emphasizes the streamlined nature of its financing process.

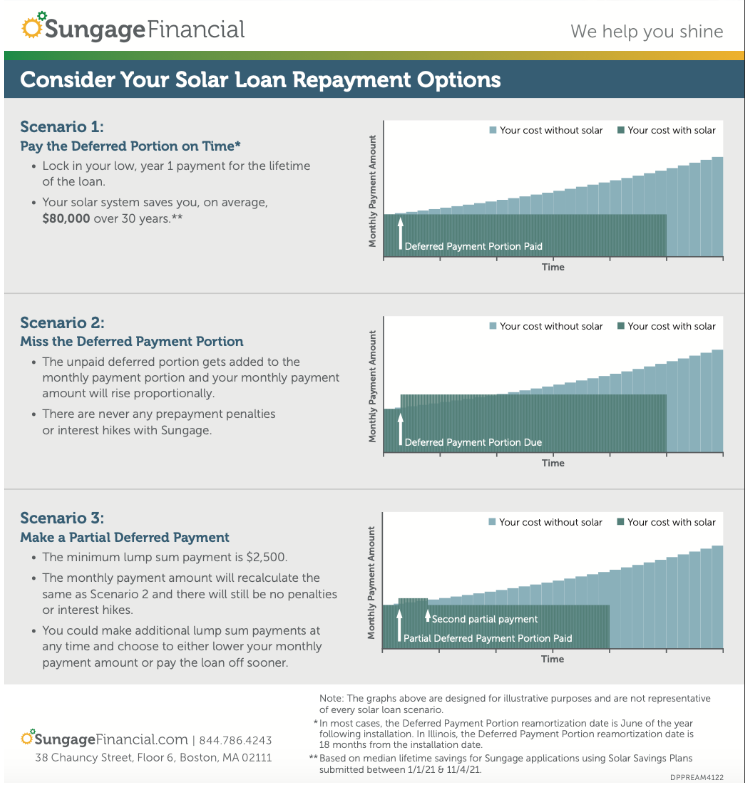

Re-Amortization Flexibility for Homeowners

The commitment to flexibility at SunGage extends beyond the initial loan setup, offering unlimited re-amortizations that allow homeowners to adjust their payment schedules as needed, without penalties. This feature is especially beneficial for those whose financial situations may change over time, providing the flexibility to adapt loan terms accordingly.

The Re-Amortization Options Flyer below illustrates various repayment scenarios, demonstrating how SunGage enables homeowners to manage their loans without additional fees or unexpected interest rate hikes. This re-amortization option makes it easier for homeowners to maintain financial control, ensuring that their solar investment remains manageable, even as circumstances evolve.

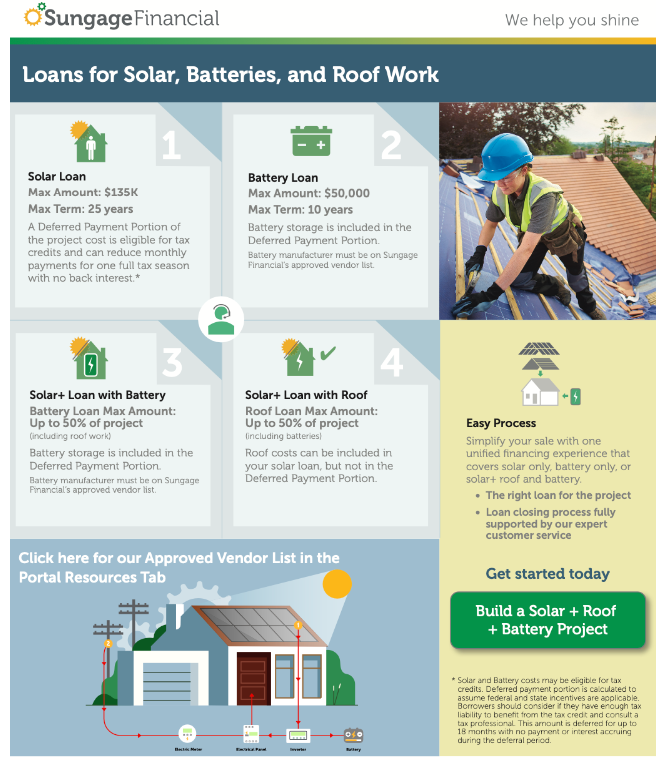

Comprehensive Financing for Solar, Roofs, and Batteries

SunGage goes beyond standard solar financing by offering comprehensive loan options that cover not only solar installations but also roofs and battery storage systems. This integrated approach provides homeowners with a one-stop financing solution for upgrading their home’s energy efficiency and resilience.

The SunGage Roof and Battery Financing Flyer outlines how homeowners can combine solar installations with other energy improvements, such as roof replacements and battery backups, to achieve greater energy independence. By offering flexible financing that covers multiple aspects of home energy systems, SunGage makes it easier for homeowners to transition to clean energy without the need for multiple loans or providers.

This flyer demonstrates SunGage’s commitment to comprehensive financing, providing options that cover a wide range of home energy upgrades.

Supporting Homeowners Through Every Step

SunGage’s customer-centric approach ensures homeowners receive robust support throughout their solar journey.

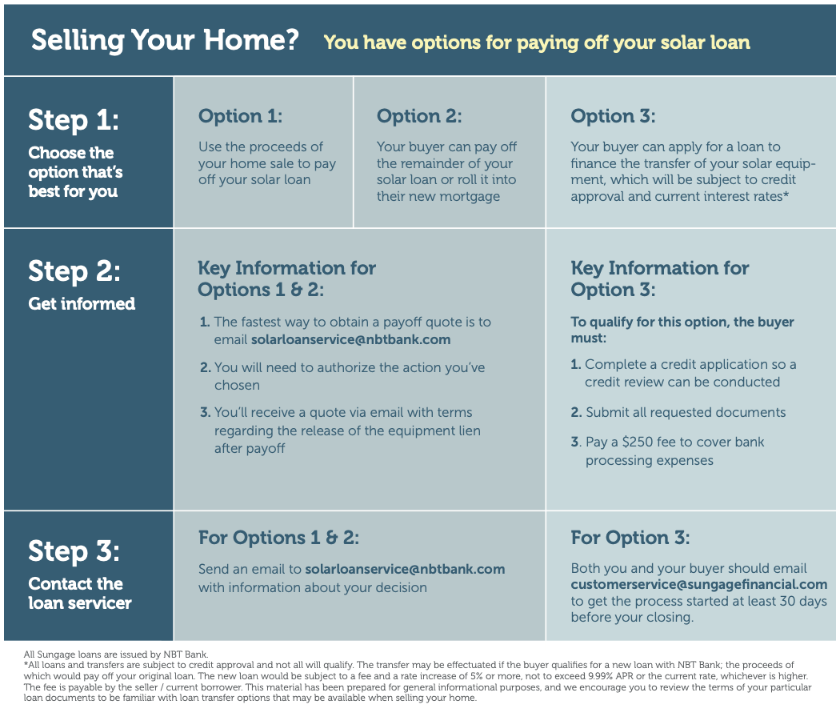

The SunGage Sell Home Flyer highlights the options available to homeowners who sell their property before their solar loan is fully paid off, illustrating the flexible and customer-friendly nature of SunGage’s financing solutions.

The flyer outlines SunGage’s support to homeowners selling their homes, ensuring a smooth transition of solar loan responsibilities.

Conclusion: A Trusted Partner in Solar Financing

With a legacy of innovation and a commitment to making solar energy accessible, SunGage Financial has established itself as a leader in the solar financing industry. From pioneering the first residential solar loans to offering flexible, customer-focused products, SunGage consistently provides homeowners with the financial tools needed to embrace clean energy with confidence.

Whether you’re considering a solar installation, roof work, or battery storage, SunGage’s comprehensive financing solutions and exceptional customer support make them a trusted partner on your solar journey. With SunGage, homeowners can invest in their energy independence and make a positive impact on the environment with a financing partner they can rely on.