This article is based on information obtained from a meeting with a representative of Figure HELOC and Kayl Enders of AES on October 8th, 2024. Please note that loan terms, conditions, and interest rates are subject to change.

Financing home improvements and solar installations can be one of the most significant financial decisions homeowners face. A HELOC (Home Equity Line of Credit) is a line of credit that uses the equity in your home as collateral, offering flexibility for significant projects. During a recent meeting with a Figure HELOC representative and Kayl Enders of AES, several key insights emerged about how Figure HELOC addresses common challenges. This article explores whether Figure HELOC stands out as the best loan option by examining its features, benefits, and comparisons with traditional financing alternatives

The Traditional Financing Challenge

Homeowners often view financing for significant projects like solar installations as daunting. Traditional HELOCs can be cumbersome, with lengthy approval processes and high fees that deter potential borrowers.

“Solar isn’t just about being environmentally conscious; it’s about improving your assets and owning your power.”

The Figure HELOC representative emphasized, highlighting that the security of solar loans is often underestimated. Despite the low risk of default, the solar industry has struggled to offer financing solutions that are both accessible and affordable. This gap presents an opportunity for innovative lenders like Figure HELOC to make a significant impact.

How Figure HELOC is Changing the Game?

Figure HELOC aims to simplify the financing process and offer more flexible terms than traditional HELOCs. Here are the standout features discussed during the meeting:

1. Transparent Fees and Competitive Rates

Figure HELOC charges only an origination fee, which is standard in the mortgage world and incorporated into monthly payments. “There are no dealer fees, only the origination fee, which is relatively standard and doesn’t add extra costs upfront,” the representative clarified. This approach avoids the burden of additional upfront costs that many borrowers face with traditional HELOCs.

The APRs range from 6.25% to 15%, depending on creditworthiness and market conditions. Rates are fixed, ensuring predictable monthly payments. “Our founder, who also founded SoFi, brings incredible innovation to the HELOC product, allowing us to leverage the latest technologies and streamline the process,” the representative highlighted, underscoring the advanced financial strategies backing Figure HELOC.

2. Streamlined Income Verification

A key advantage of Figure HELOC is its sophisticated income verification process. By partnering with Plaid, Figure can directly connect to borrowers’ bank accounts, making income verification straightforward and rapid. “Our income verification process is a game-changer. Partnering with Plaid allows us to connect directly with bank accounts, making it fast,” the representative shared.

For those uncomfortable sharing bank details, Figure offers alternative methods like uploading W-2s, though this requires manual review and slightly longer processing times.

3. High Approval Rates and Loan Flexibility

Figure HELOC boasts a high approval rate, with a breakage rate between approval and actual funding of only 10-15%. “The breakage rate between approval and actual funding is about 10-15% due to unique borrower circumstances, which indicates a high approval rate overall,” the representative mentioned.

Additionally, Figure offers a higher Combined Loan-to-Value (CLTV) ratio of up to 85%, compared to the standard 70-80% offered by traditional HELOCs and community credit unions. “Our CLTV is quite high for the industry, up to 85%, which allows borrowers with higher mortgage balances or shorter home ownership periods to access more equity,” the representative noted. This feature makes Figure HELOC more accessible to a broader range of homeowners.

4. Comprehensive Support and Future Enhancements

Figure HELOC provides robust support through a dedicated Charlotte, North Carolina team. “We have a full support team in Charlotte, North Carolina, to address any issues that arise during the application process,” the representative assured.

Looking ahead, Figure is committed to enhancing its offerings for the solar market. Plans include developing a contractor portal and introducing features like refinancing solar loans. “We’re actively working on further features like refinancing solar loans to enhance our product offerings in the solar market,” the representative stated.

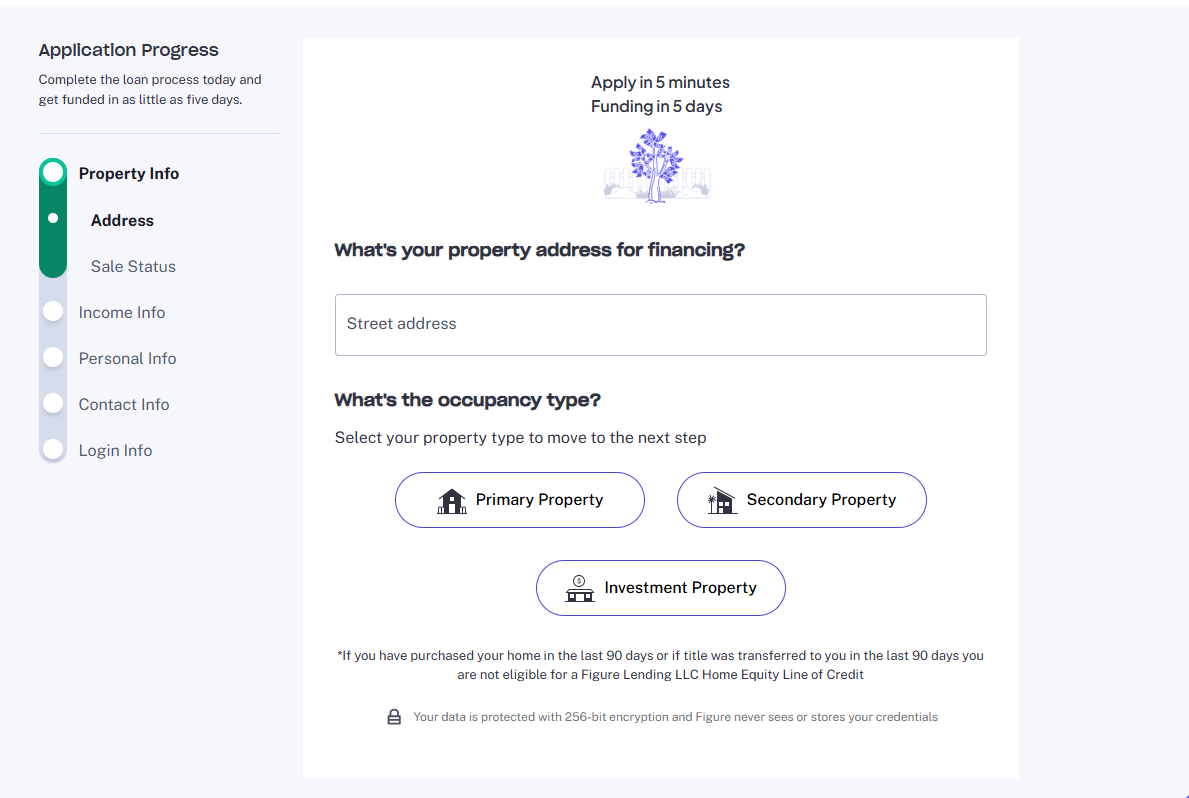

Step-by-Step: How to Apply for Figure’s HELOC?

Applying for a Figure HELOC is designed to be straightforward and efficient. Here’s a step-by-step guide to help you navigate the application process, key considerations, and tips for installers on communicating this option to customers.

Step 1: Register Online

Visit the Figure HELOC application page. Click on the “Register” button to begin your application.

This is a video that describes the application process

This is a video that describes the required notary process

Step 2: Provide Personal Information

Enter your details, including your name, contact information, and social security number. “Our digital application process is seamless, allowing you to input all necessary information quickly,” the representative noted.

Step 3: Verify Your Income

Choose your preferred method for income verification. You can either:

-

Connect Your Bank Account: Use the Plaid partnership to connect your bank account directly for fast and accurate income verification. “Partnering with Plaid allows us to connect directly with bank accounts, making income verification fast,” the representative shared.

- Upload Documentation: Alternatively, upload a photo of your W-2 or other tax documents if you prefer not to connect your bank account. Note that this method requires manual review and may add a couple of days to the process.

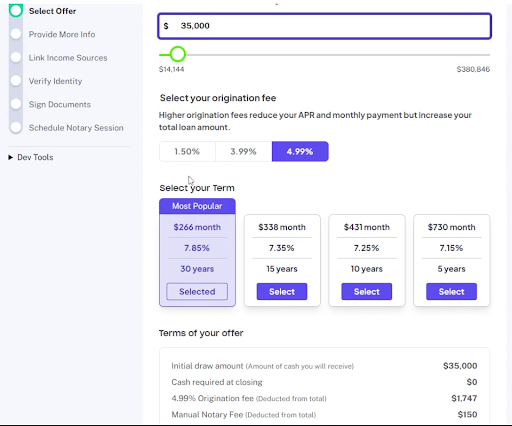

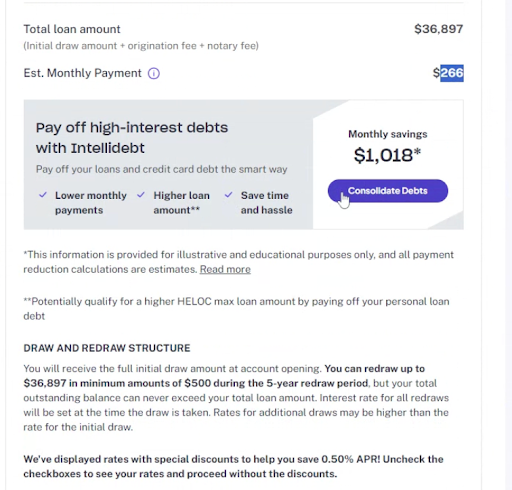

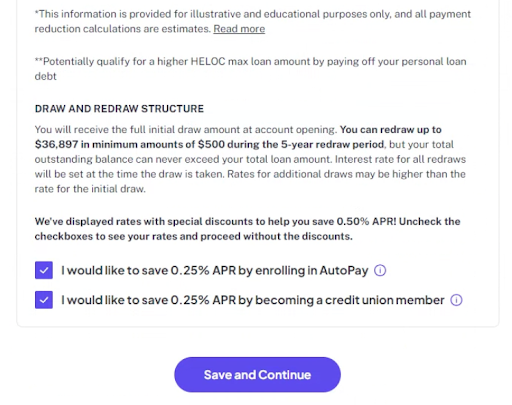

Step 4: Review Loan Terms

Based on your input and eligibility, review the loan terms offered, including the interest rate, loan amount, and repayment period. The representative emphasized that “we ensure transparency by clearly outlining all loan terms during the application process. “

Step 5: Submit the Application

After reviewing your loan terms, apply. Figure HELOC aims to close loans for eligible applicants within five days. “If you’re a sole owner of a primary residence and can verify income through bank accounts, you can close in as little as five days,” the representative explained.

Step 6: Receive Funds

Once approved, the loan amount is directly disbursed to your chosen account upfront. “If you’re asking for $35,000, you are probably going to get $35,000 in my account in five days,” the representative said.

What You Need to Know Before Applying for Figure HELOC?

Before applying for a Figure HELOC, consider the following requirements and eligibility criteria:

Specific Requirements Coverage (as of 10/03/2024):

A. Homeownership: Must be a homeowner. Available in all states except Hawaii (HI), Kentucky (KY), New York (NY), and West Virginia (WV).

B. Credit Score (FICO): Minimum FICO Score es de 640 (720 for Oklahoma).

C. Loan Amount Based on FICO Score:

- 640-679: Up to $125,000

- 680-699: Up to $200,000

- 700-739: Up to $250,000

- 740-759: Up to $275,000

• 760+: Up to $400,000

D. Property Type: Single-family residences, townhouses, duplexes, planned urban developments (PUDs), and most condos.

E. Existing Mortgages/Liens: No more than two existing mortgages/liens on the property.

F. Debt-to-Income Ratio: Must be under 50% and, in many cases, under 43%.

G. Credit History:

- Minimum of 2 years credit file.

- No delinquencies on the current mortgage in the last 6 months.

- No foreclosure in the past 5 years.

- No collections.

- No bankruptcy in the previous 7 years.

- No undischarged bankruptcies.

Additional Requirements:

- Verification of Income: All applicants are subject to income verification.

- Eligible Properties: Primary or secondary residences.

- Ineligible Properties: Co-ops, commercially zoned real estate, multifamily real estate, manufactured housing, earth or dome homes, timeshares, log homes, houseboats, or mixed-use properties.

Comparing Figure HELOC to Traditional and Specialized Solar Loans

When compared to traditional HELOCs and specialized solar loans like SunGage, Figure HELOC offers several distinct advantages:

Speed and Convenience: Figure’s digital-first approach enables faster closings, often within five days, significantly reducing the waiting time associated with traditional HELOCs. “We’re changing the game by making the HELOC process much quicker and more transparent. Unlike traditional, time-consuming HELOCs, our process is streamlined and efficient,” the representative explained.

Flexibility in Repayment: Figure HELOC provides greater financial flexibility with options to recast the loan and make additional payments without penalties. “The ability to recast the loan and make additional payments without penalties provides financial flexibility,” the representative noted.

Higher CLTV and Lien Positions: Figure can handle second and third lien positions, offering more flexibility for borrowers with existing mortgages. “Our CLTV is up to 85%, allowing more homeowners to qualify and access more equity,” the representative highlighted.

However, specialized solar loans may offer tailored features such as integration with solar tax credits, which Figure is actively working to incorporate based on contractor feedback.

Insights

The meeting with the Figure HELOC representative and Kayl Enders of AES shed light on several critical aspects that underscore the strengths of Figure HELOC:

No Dealer Fees: The origination fee is the only cost seamlessly integrated into monthly payments. “There are no dealer fees, only the origination fee, which is relatively standard and doesn’t add extra costs upfront,” clarified the representative.

High Approval Rates: With a breakage rate of just 10-15%, Figure HELOC demonstrates a high approval success. “The breakage rate between approval and actual funding is about 10-15% due to unique borrower circumstances, which indicates a high approval rate overall,” mentioned the representative.

Founder’s Expertise: The leadership from the founder of SoFi brings innovation and advanced technology to Figure HELOC. “Our founder, who also founded SoFi, brings incredible innovation to the HELOC product, allowing us to leverage the latest technologies and streamline the process,” highlighted the representative.

Commitment to the Solar Market: The figure is dedicated to developing tools and features specific to the solar industry. “We’re committed to the solar market and are actively developing features like a contractor portal to serve solar installers and their customers better,” stated the representative.

Transferability and Loan Management: Loans can be seamlessly paid off through the home sale without penalties. “If you sell your home, the remaining loan balance is typically paid off from the sale proceeds without any penalties,” explained the representative.

These insights reveal Figure HELOC’s dedication to creating a superior loan product tailored to the needs of homeowners, especially those investing in solar energy and significant home improvements.

Is Figure HELOC the Best Option for Most Homeowners?

Figure HELOC distinguishes itself by addressing joint financing issues in the home improvement and solar installation sectors. With features like a higher CLTV ratio, no prepayment penalties, and a fully digital application process, Figure HELOC provides significant advantages for homeowners leveraging their home equity for major projects.

“We’re here to make the HELOC process as seamless and beneficial as possible, helping homeowners unlock their liquid cash without the traditional hassles,” affirmed the representative.

While it may not be the perfect fit for every homeowner, Figure HELOC offers robust solutions to significant pain points in the industry and is worth considering as a viable financing option. Homeowners should carefully assess their individual needs, compare multiple loan options, and consult with financial advisors to make an informed decision that best suits their financial situation and long-term goals.

Disclaimer

The information provided in this article is based on a meeting transcript and is intended for informational purposes only. Loan terms, interest rates, and features are subject to change and may vary based on individual qualifications and market conditions. You should consult with Figure directly or use their online tools for personalized information.